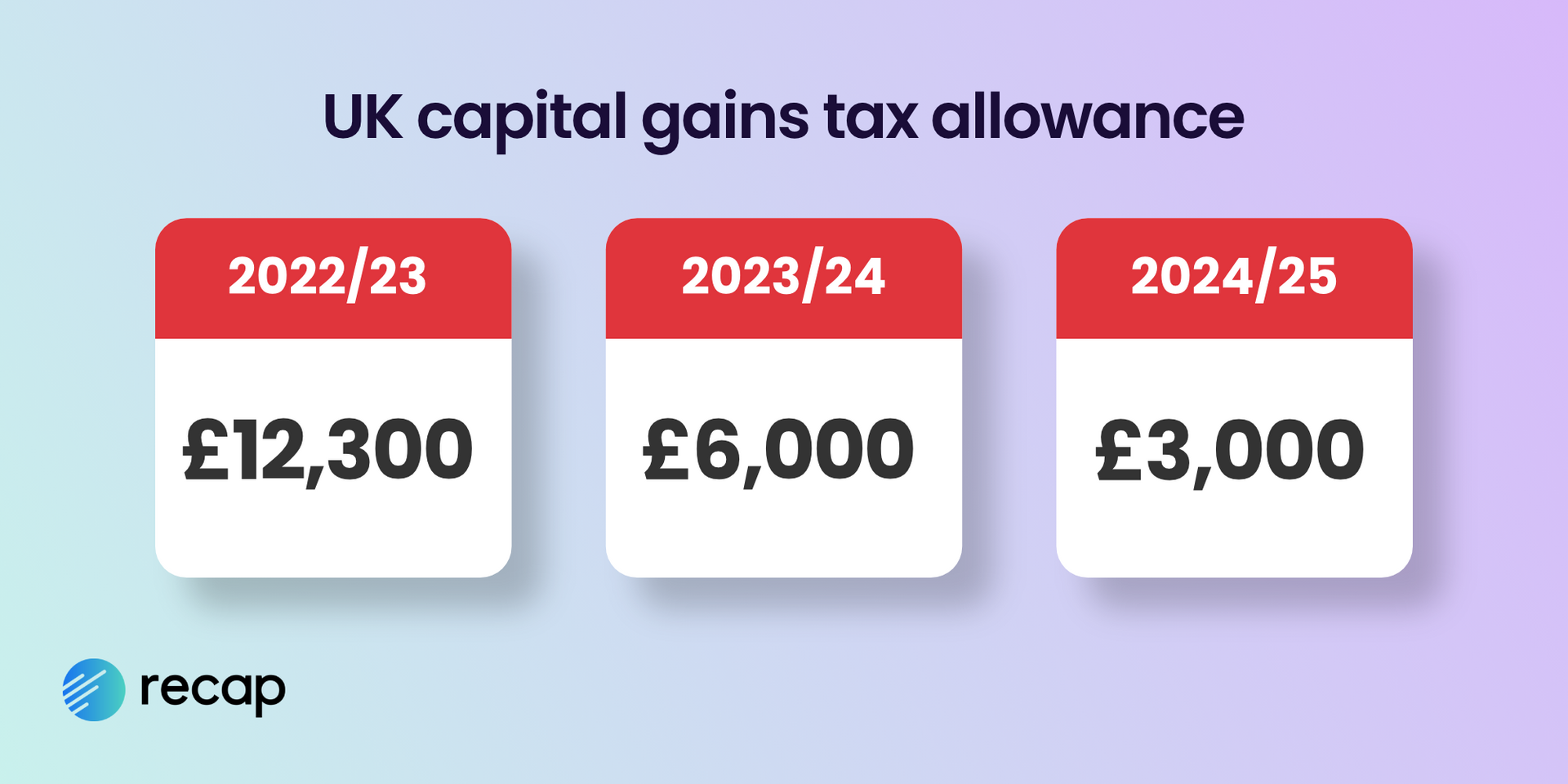

Uk Capital Gains Tax Allowance 2025/25. There are some changes and some. In 2025, this will be reduced further from £6,000 to £3,000.

From april 2025, the uk capital gains tax allowance (“cgt”) will be reduced from £12,300 to £6,000 for individuals and personal representative for the 2025/24 tax year and then further reduced to £3,000 in 2025/25.

Capital Gains Tax Law 2025 Jere Garland, For the 2025/2025 tax year capital gains tax rates are: Capital gains tax rates in the uk for 2025/25.

ISA allowance what is it and how can you make the most of it?, From april 2025, the uk capital gains tax allowance (“cgt”) will be reduced from £12,300 to £6,000 for individuals and personal representative for the 2025/24 tax year and then further reduced to £3,000 in 2025/25. It’s the gain you make that’s taxed, not the amount of money.

Capital Allowances 202525 Claritax Books, Annual capital gains tax allowance: It’s the gain you make that’s taxed, not the amount of money.

How to calculate capital gain tax on shares in the UK? Eqvista, It’s the gain you make that’s taxed, not the amount of money. Rob morgan rounds up the income tax brackets, allowances and limits for the uk 2025/25 tax year.

Know Capital Gain Property Tax wood,my.id, Capital gains tax adjustments for 2025/25: From april 2025, the uk capital gains tax allowance (“cgt”) will be reduced from £12,300 to £6,000 for individuals and personal representative for the 2025/24 tax year and then further reduced to £3,000 in 2025/25.

UK Tax Rates 2025 Calculating Crypto Capital Gains & Tax, Annual capital gains tax allowance: However, the spring budget announced that the.

UK Capital Gains Tax Calculator How Much Will You Pay? YouTube, Income tax bands of taxable income. Capital gains tax rates in the uk for 2025/25.

2025 Capital Gains Tax Rates Alice Brandice, The latest adjustments to capital gains tax (cgt) carry significant. How much will you pay?

What Is the Capital Gains Tax Allowance for 2025/24 UK? TPBC, The government has previously announced that the cgt annual exempt amount will reduce from £6,000 to £3,000 from april 2025. Make the most of changes to annual and lifetime allowances for.

The Proposed Changes to Capital Gains Tax BpH, Capital gains tax rates and allowances. Capital gains tax is the.

:quality(80))